Caravan Finance Calculator

Use our easy caravan loan calculator to figure out how much you could borrow

Why our calculators different

Exact match

You can get an exact rate match instead of a generic estimate.

All fees included

Our monthly repayment estimates are fully inclusive of all fees of the lender, so no need to worry about hidden surprises.

Fully flexible

We'll look at a wide range of inputs to give you a personalised calculation across a variety of loan structures.

Don't take our word for it

We always recommend a second option. Read our customer reviews

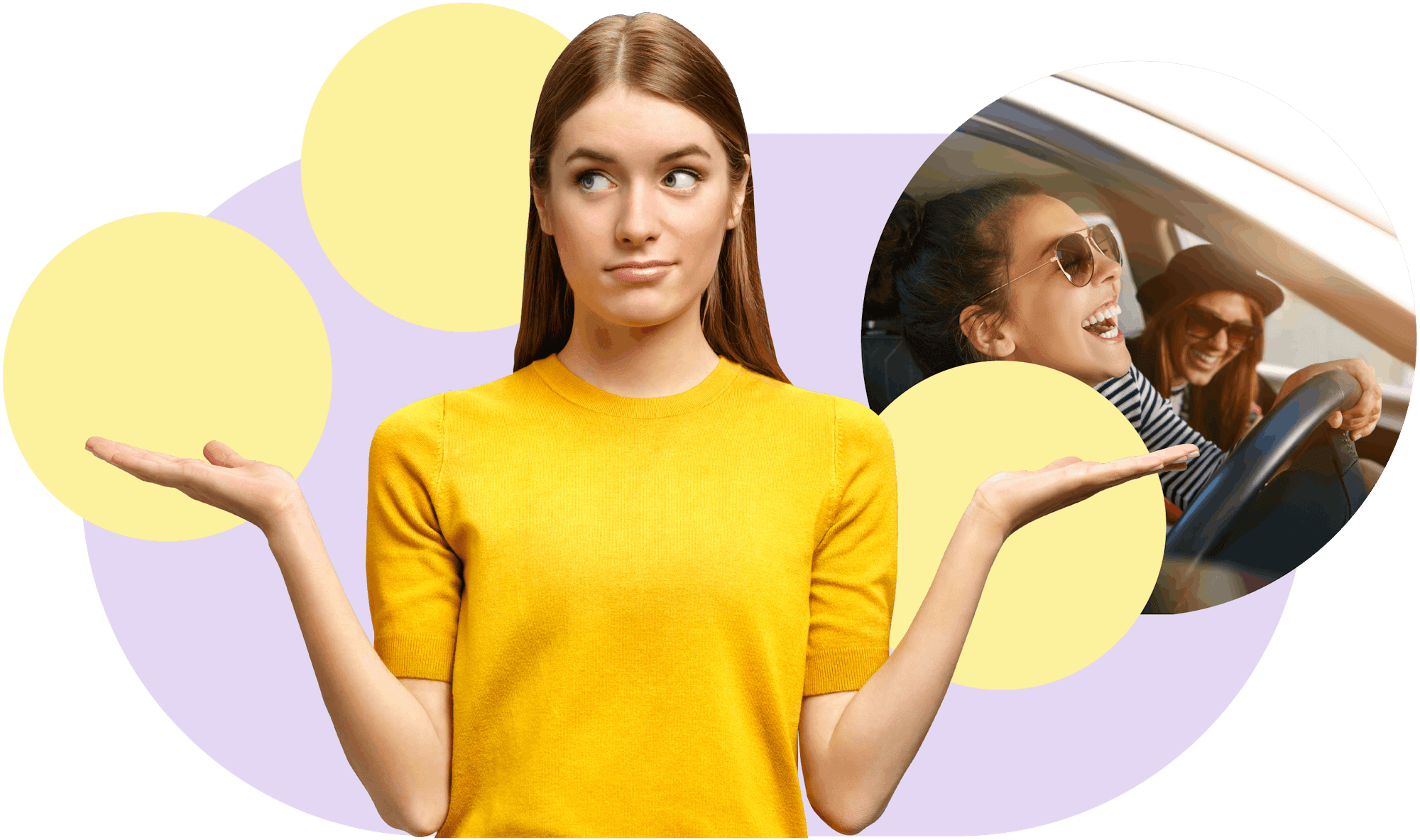

Caravan Finance With Driva

Borrow the full amount

Whether you’re buying a new or used caravan, you can borrow the full amount of the caravan's purchase price and avoid dipping into your savings!

Flexible loan types

From balloon payments to large deposits, Drive offers a wide variety of loan structures to suit your individual circumstances and needs.

Quick & friendly customer service

Our friendly and knowledgeable finance team is available to help you navigate the world of caravan finance and find your perfect caravan loan. If you need help finding the actual caravan, we can help with that too!

Have a question?

What type of caravans can I get a loan for?

From motorhomes and camper trailers to RVs and everything in between, if it’s got wheels, Driva can help you finance it! Whether you’re buying your very first home on wheels or are a season-ed caravanner, Driva can help you find the perfect caravan loan or camper trailer finance for your personal circumstances. Use our caravan loan calculator to find out your estimated interest rate and repayment amounts.

Do Driva’s lenders charge fees?

Every car loan lender charges fees - the important part is making sure you account for them when deciding which lender to go with. These fees will vary between lenders - for example, some lenders might charge early repayment fees or redraw fees.

All lender fees and charges are automatically built into Driva’s personalised quotes and into our car finance calculator, so the monthly repayment figure you see is exactly what you’ll have to pay each month (no hidden fees!).

Driva works with a wide panel of lenders to give you the confidence that the options you’re seeing are a good fit for your personal circumstances as well as the vehicle you’re thinking about.

Does my credit score have an impact on my rate?

In most cases, yes. For many lenders, your credit score is one of the main factors that will be assessed when deciding whether you’re eligible for a loan. In fact, in some cases, your credit score will impact how your interest rate is set - the higher your credit score, the lower interest rates you’ll be able to access.

However, for some lenders, your credit score is less important, and other factors like your income, living situation and employment status will be more heavily considered.

Will applying for quotes impact my credit score?

No. Getting your personalised quotes with Driva won’t have any impact on your credit score.

When you get your quotes, Driva runs a ‘soft credit check’. This means we’re able to access the credit score that lenders will use to price your car loan, without recording an inquiry on your file or impacting your score in any way.

Once you’ve decided on your preferred lender, submitted your final application to Driva, and we’ve checked to make sure you’re likely to be approved, only then will we share your application with your chosen lender.

What kind of loan do I need for a caravan?

There are a number of caravan finance options available, from personal loans to secured loans, and the easiest way to find out which ones you’re eligible for is to get a quote online. You’ll just need to tell us a few details about yourself and the type of caravan you’re looking to buy, and we can give you personalised rates in just minutes. Whether you’re looking for a secured loan on an RV or a commercial loan to finance a caravan for your new business, Driva has you covered.

Can I get a loan for a second hand caravan?

Absolutely! If you’re new to the world of caravans or are just looking to get a great deal, buying second hand could be a great option for you. Your main options for buying a second hand caravan are most likely going to be buying through a dealership or from a private seller. Before you start shopping, there are a few factors you should consider:

- How often are you planning on using the caravan?

- What size caravan do you need?

- What essential features do you need? And which could you live without?

- How much do you want to spend in total? How much can you afford to spend on monthly repayments?

What is a comparison rate?

A comparison rate is used to help you understand the true cost of a loan. Unlike the Annual Percentage Rate (APR) rate, it includes almost all of the fees that lenders will charge you (but doesn’t include stamp duty fees). You should consider comparison rates as the key metric when comparing car loan quotes from Driva. We’ll clearly specify the comparison rates of each quote so you can clearly see which is going to cost you the least. We recommend relying on the comparison rate or monthly repayment figure when comparing rates, as the quoted APR can be misleading.

How quickly do caravans depreciate?

Like all other vehicles, caravans will depreciate over time. The rate of depreciation will depend on several factors such as the make and model of the caravan, the age of the caravan, the condition it's in, and how well it has been maintained. Typically, caravans will lose the most value in the first three years after purchase. After this period, the rate of depreciation will usually slow down.

If you're buying a brand-new caravan, camper trailer or RV vehicle, it's important to keep in mind that the moment you drive it off the dealership, it will start to lose value. This means that if you're looking to sell your caravan in the future, you may not be able to recoup the full amount you paid for it. However, if you're buying a used caravan, it may depreciate at a slower rate than a new caravan, which means that you may be able to get more of your money back when you sell it.

It's important to note that depreciation is a normal part of owning any vehicle and shouldn't be the only factor that influences your decision to buy a caravan. Other factors such as your lifestyle, budget, and travel goals should also be considered when making this decision. At Driva, we understand that buying a caravan is a significant investment, which is why we provide personalised caravan loans to help you get the best interest rates for your caravan purchase.

What is a comparison rate?

A comparison rate is a rate that can be used to work out the true cost of a loan. It includes most of the fees that lenders will charge you, excluding fees like stamp duty.

Driva recommends using comparison rates as the key metric when comparing car loan quotes. We’ll clearly specify the comparison rate on each loan, so you can get an accurate representation of how much each loan option would cost you per month.

How does pre-approval work?

If you’re considering getting a caravan loan, pre-approval can be a great way to help you save both time and money. Caravan loan pre-approval is essentially when your lender makes an in-principle agreement to lend you a specific amount of money in order to buy a caravan. The agreement is subject to receiving an invoice from the dealership or private seller as well as obtaining comprehensive insurance.

One of the major benefits of pre-approval is that you’ll be able to start shopping with a set budget in mind. This can help give you a stronger bargaining position, as you’ll have the confidence to negotiate a good price for your new dream caravan.

How long can you finance a caravan for?

At Driva, we offer flexible finance options for caravan purchases. You can finance a caravan for a period of up to 7 years. However, the actual loan term may vary depending on the lender and the loan amount. Use our caravan finance calculator above to get your estimated monthly caravan loan repayments quickly and don’t forget we also provide camper trailer finance, car loans & more!

Ready to get started?